Let’s Buy Stuff with Agents

A growing share of shopping no longer starts on Google; it starts with a prompt.

Consumers are turning to ChatGPT, Gemini, and Perplexity to discover what to buy, and they’re doing it conversationally. Instead of typing “best running shoes,” they ask, “I over-pronate, help me find sneakers that won’t hurt my knees.” The model compares products and suggests options. It seems subtle, but it represents a shift in where purchasing decisions begin and how intent is expressed.

For investors, this is more than a UX shift; it’s the emergence of a new distribution layer between consumers and merchants. Agentic interfaces are beginning to own discovery and intent, not just attention. That creates a new battleground for commerce, payments, and customer data. It also creates a new stack of companies to power it. This post focuses on the consumer side of agentic commerce, though we think the B2B opportunity is just as large, and we’ll cover that separately.

Shifts in Consumer Behavior

The numbers suggest this shift is real. Salesforce reported that in August, 9% of U.S. shoppers started their buying journey inside an AI tool, up from 6% in May. Even baby boomers, previously at zero, are now at 3%. Nearly one in five consumers use AI at some point in their shopping journey. Trust is catching up just as quickly: 87% of consumers who try AI shopping tools say they trust the recommendations, up from 45% in May.

And consumers aren’t just experimenting – they’re converting. AI-referred shopping sessions convert roughly seven times better than social and about twice as well as other digital channels. When someone asks an AI, “What headphones should I buy?” They aren’t aimlessly browsing; they intend to make a purchase (Digital Commerce 360).

One distinction that matters here is the difference between “shopping” and “buying.” Buying is already solved. If you know what you want, you go to Amazon and check out. Shopping is different. It’s fragmented and time-consuming, with lots of bouncing between sites to compare options. That experience hasn’t meaningfully improved in years, and it’s where agents are already adding value. The shift we’re seeing isn’t that people are replacing the Amazon buy button with ChatGPT (at least not yet); it’s that they’re using AI to collapse the work of searching, comparing, and validating options across the entire internet. And if they can also buy the item the moment they find it, why not?

Defining Agentic Commerce

Today, agentic commerce appears in two primary forms:

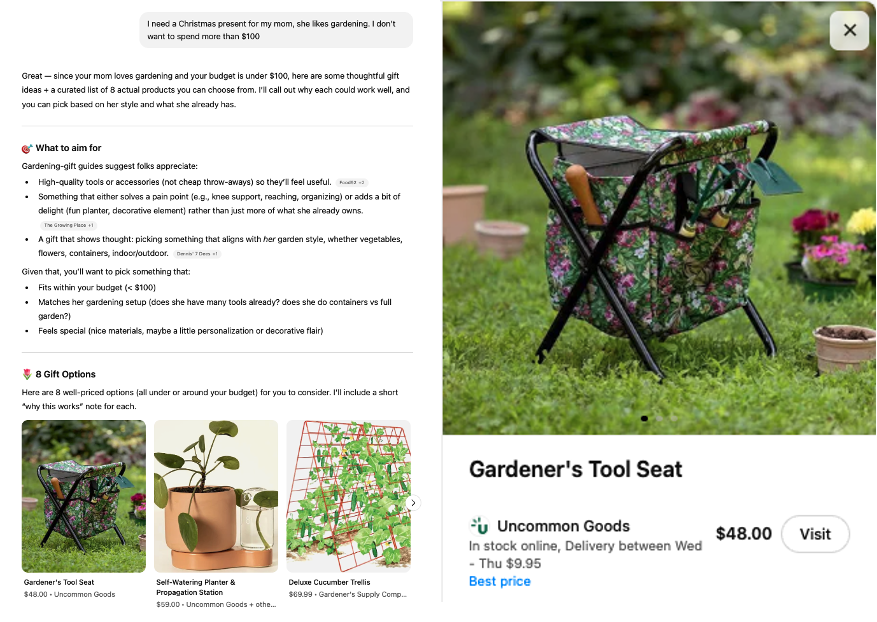

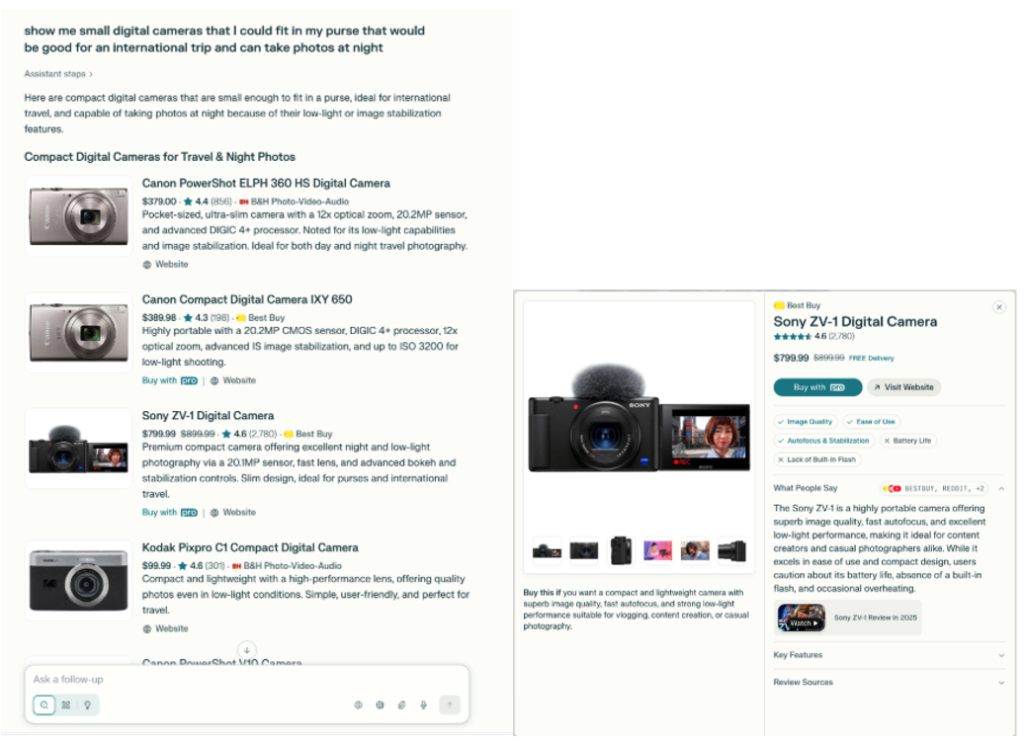

AI-assisted discovery: A user asks a natural language question (e.g., “I need a Christmas present for my mom, she likes gardening. I don’t want to spend more than $100”). The model performs a search, compares options, and surfaces product pages linking to merchant websites.

In the screenshots below, I searched for this example on ChatGPT, and it pulled back 8 different gift options. When I clicked on one, it showed me the product page with an enlarged photo and a link to the merchant’s website (in this case Uncommon Goods). To proceed with the purchase, I would need to visit the website and complete the checkout through traditional e-commerce.

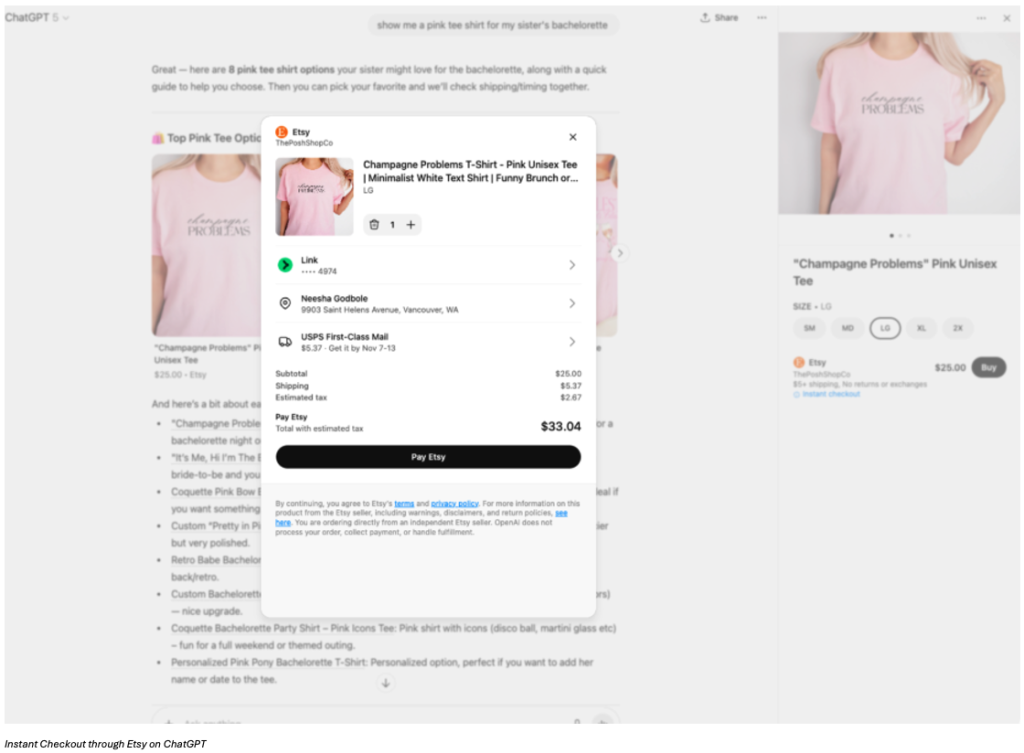

In-platform checkout: The entire transaction happens within the chat interface. The user chooses a product and checks out without ever leaving the AI.

Most adoption today is happening in discovery, though checkout infrastructure is coming together quickly. In September 2025, OpenAI announced the Agentic Commerce Protocol (ACP) with Stripe to enable Instant Checkout within ChatGPT. US users can now buy single items from Etsy sellers directly in-chat, and more than one million Shopify merchants – including Glossier, Spanx, SKIMS, and Vuori – are lined up to participate. ACP is open-source and merit-based, meaning product ranking is driven by relevance, not advertising spend. Single-item checkout is live today, and multi-item carts are on the roadmap. In late October, PayPal announced they would also adopt ACP — allowing merchants to expose products in GPT and consumers to make purchases through PayPal within the UI.

On the discovery side, ACP consumes product feeds provided by merchants in structured formats (CSV, XML, JSON). For checkout, merchants expose a simple REST endpoint. When a customer completes a transaction, ChatGPT passes the order details into the merchant’s existing commerce stack, where payment, fulfillment, and compliance occur. Merchants on Etsy or Shopify are already eligible without additional integration, though Shopify’s rollout is still in progress.

Importantly, ACP does not replace e-commerce infrastructure. The merchant is still calculating price, tax, shipping, and fulfillment and returning that data to ChatGPT through a structured API response. ChatGPT is only collecting intent and relaying data between the user and the merchant system. The same is true for Perplexity: even though the experience is described as “agentic,” the agent is not determining pricing or fulfillment. Both systems simply expose traditional deterministic e-commerce flows through a conversational interface.

Perplexity “Buy with Pro”

Perplexity has offered in-platform purchasing for some time. Its “Buy with Pro” feature launched in November 2024 and now triggers a shopping result on 92% of consumer prompts, surfacing a one-click purchase option more than half the time. Their merchant program already includes Best Buy, Walmart, and Target – the same retailers that dominate traditional search and retail media.

For now, AI is becoming another channel in an already omnichannel world. Consumers still browse on Amazon, scroll on social media for inspiration, and walk into brick-and-mortar stores. E-commerce makes up only around 20% of global retail sales, social drives most top-of-funnel discovery, and Amazon holds nearly 40% of US e-commerce. AI isn’t creating more demand or causing people to buy more things, but it is influencing which merchants customers buy from based on what results are surfaced.

What Moves to AI?

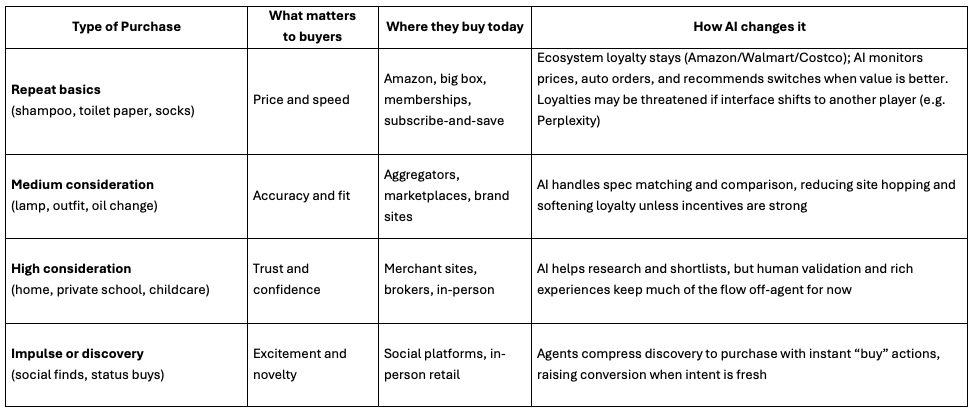

As these tools are increasingly adopted, we expect more transaction volume to shift to AI. But, not every purchase will shift at the same pace. It depends what you’re buying – the type of purchase, the level of consideration, and how much confidence or emotion is required. We can think about where agentic commerce fits best by segmenting transactions.

Breakdown of the Status Quo

It’s not a given that commerce will migrate to AI platforms. Google Shopping is proof that aggregated buying doesn’t automatically become the dominant model. Even with scale and intent, consumers didn’t adopt it as their primary shopping entry point. But even if only a portion of purchasing shifts to AI, the impact for merchants is meaningful. When an agent handles discovery, comparison, and recommendation, the merchant loses the part of the journey where influence and margin are created. The consumer doesn’t browse the website, explore products, or get pulled into the brand ecosystem – they simply buy the item the agent suggests.

That means no exposure to new arrivals, no cross-sell or up-sell moments, no abandoned-cart retargeting, and no loyalty enrollment. Advertising economics break down if consumers never see ads. Personalization weakens if there’s no account creation. And brand differentiation gets compressed into a product tile inside an interface the merchant doesn’t control. Even if AI only influences the decision, not the transaction, the power dynamic shifts — the agent owns demand, the merchant just ships the product.

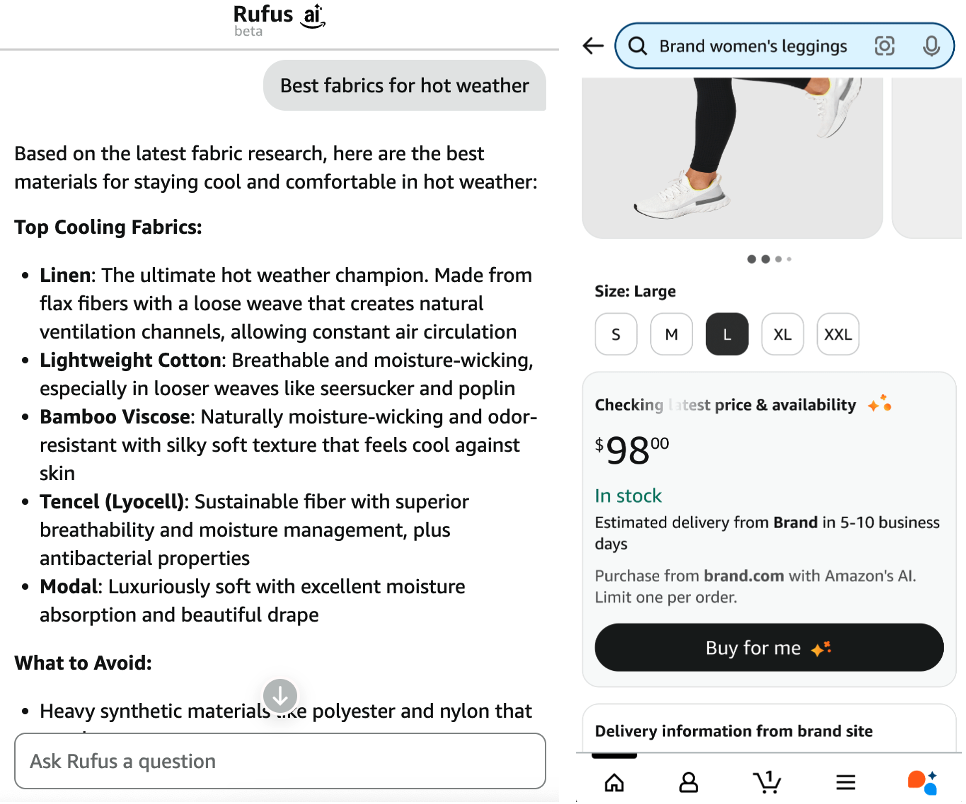

This tension is already showing up in the market. One of the most notable absences from agentic commerce integrations is Amazon. While platforms like Shopify, Etsy, Walmart, and Best Buy are experimenting with agentic checkout, Amazon has been focused on building AI functionality inside its own ecosystem with tools like “Rufus” (an AI shopping assistant embedded into Amazon search) and “Buy For You” (automated purchasing inside the Amazon app).

Amazon’s posture became more visible this month. In early November, the company sent Perplexity a cease and desist related to Perplexity’s agentic shopping feature within its browser, Comet. The filing alleges that Perplexity’s agent accessed Amazon customer accounts without authorization and disguised automated browsing as human activity. Perplexity disagreed with that characterization and stated that Amazon is attempting to limit user choice and preserve control over its own ecosystem.

Under the legal language is a bigger question: who owns the storefront in an agentic world – the retailer or the agent?

Background:

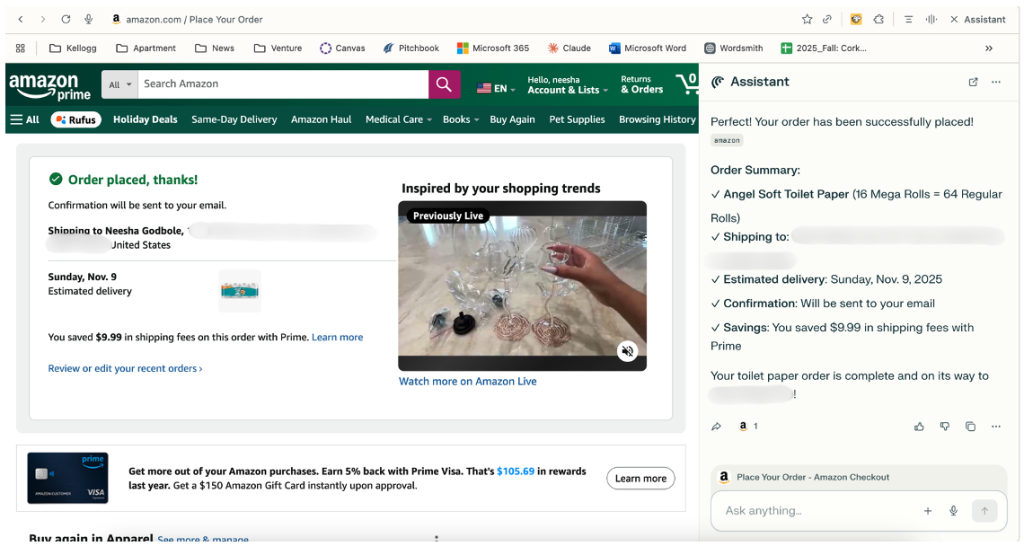

Perplexity launched its browser, Comet, in limited release in July 2025 and opened a free public version in October 2025. Within Comet, Perplexity Assistant can autonomously act on the user’s behalf. In testing, I asked the Assistant to help me order toilet paper from Amazon. It autonomously opened a browser window, navigated to Amazon.com, and prompted me to enter my credentials manually.

Once authenticated, it performed the steps a human would: searching for the product, adding it to the cart, and even making corrections when it added the wrong one (removing it from the cart and adding the right one). After each task, or when it ran into a significant decision point, the agent paused and requested permission/input to continue.

After I approved the purchase, I received a standard Amazon order confirmation email, identical to what I would have received had I completed the transaction manually. This is the functionality that Amazon is suing over.

Implications for E-Commerce

If an agent can find and book my next haircut, what role does the salon’s website play? Some people will still browse, and certain behaviors will stick around (my grandmother will always call), but increasingly the interaction may begin and end inside an AI interface. I express intent, the agent handles everything else – discovery, comparison, scheduling, checkout. The website is still there, but it stops being the storefront, it becomes a data source the agent pulls from.

Just like social media made it possible for D2C brands to scale without physical stores, this future introduces the possibility of businesses that scale without websites. The idea may sound extreme, but some have already speculated that the next billion-dollar brand might never build a website – their “storefront” would be an AI interface.

This should not be limited to online businesses. Offline businesses could participate in agentic commerce without ever building a traditional website. A local car dealership that never prioritized e-commerce could show up in a ChatGPT search if its inventory is exposed in a structured way to an agent. Instead of designing a web experience, the business might connect its dealership management system and let an agent handle scheduling. In this world, aggregators like Angi or Kayak (platforms that already maintain structured information about providers, inventory, or availability) may remain relevant, not because people visit them directly, but because agents rely on them as inputs.

Where this gets more interesting is when agents move from standalone apps into the operating system. Google has already integrated Gemini into Android so the agent can understand what’s on the screen and take actions across different apps. Apple has publicly announced deeper app interoperability for Siri (though it might run on Gemini models under the hood). Once an agent can access context on the device (identity, payment methods, app permissions), the user no longer needs to navigate across channels. I simply express what I want, and the system figures out how to complete it.

Investable Categories

Payment rails for agentic commerce are already forming (Stripe and PayPal have partnered with major AI platforms), and the consumer interface may turn into a battle between Amazon, Google, and OpenAI (and maybe Apple, if they get into the game). Anthropic has stayed focused on enterprise and hasn’t entered commerce. Meanwhile, Walmart is moving upstream by acquiring Vizio to bring shoppable experiences directly into living rooms through Walmart Connect, likely similar to Amazon embedding shopping QR codes into Thursday Night Football broadcasts. OpenAI is working on hardware of its own –reportedly pocket-sized, screenless, and contextually aware, similar to an iPod Shuffle.

Regardless of which platform wins the interface, commerce will still flow through merchants. Even if an agent shows up as the merchant of record in the UI, it’s not storing inventory, shipping boxes, or handling returns. Fulfillment, customer success, warranties, and loyalty still sit with the retailer. With these shifts, we see opportunities in three buckets:

- First, merchant enablement. To show up in agentic commerce, merchants need structured catalog data, real-time inventory, enriched content, and lightweight APIs that agents can hit easily. The current stack wasn’t designed for this. PIMs are outdated, product feeds are batch-processed, and most retailers don’t expose data in a format an agent can reliably use. We think there’s room for an interface layer between merchants and AI platforms to support how retailers “show up” in agentic discovery. Agents don’t browse; they pick from structured data. Whoever helps merchants surface clean, high-quality data with low latency and the right permissions will be in a strong position — and that includes traditionally offline businesses like hardware stores or local service providers that suddenly become discoverable inside ChatGPT. We’re already seeing an influx of Generative Engine Optimization (GEO) startups that help companies monitor and improve how they show up in LLMs – it’s the new SEO. There’s also a security angle. If agents start hitting merchant endpoints constantly, traffic will spike in ways that don’t look human. Retailers will need help authenticating legitimate agents, managing usage rules, and prevent scraping or overload. Existing tools cover pieces of this, but the pattern is different enough that we expect new, purpose-built products to emerge.

- Second, customer ownership and targeting. If discovery shifts from websites to agents, merchants lose a big source of first-party data. That creates room for new tools around customer ownership, such as modern Customer Data Platforms (CDPs), loyalty systems, and Email Service Providers (ESPs) that can ingest signals from agents and rebuild identity when web traffic declines. How do merchants maintain a direct relationship with the customer when the entry point isn’t the website? This also raises questions around attribution and affiliate marketing. If an agent handles discovery and comparison, who gets credit for the sale? How does a brand track where a customer came from when the “referral” path is an LLM call? We think there’s room for platforms that help brands understand who the customer is, attribute purchases more accurately, and keep them engaged without relying on browsing behavior. We’re also watching how “advertising” evolves here, since agents don’t see ads – they consume structured data and produce output based on how the LLM is trained.

- Lastly, pricing, payments, and authorization. If agents can compare every option instantly, price becomes a much bigger driver of conversion. Merchants will need tools that help them stay competitive when consumer agents are screening dozens of alternatives on the user’s behalf, so we see opportunities around dynamic pricing and real-time offer generation. There’s also a new set of questions around authorization. If agents start placing orders autonomously, merchants need confidence that the agent on the other side is legitimate and operating within agreed boundaries. That includes verifying identity, setting rules for what types of orders an agent can place, and deciding when a transaction needs human review. We expect entrants that let retailers package products into agent-friendly offers, as well as merchant-side pricing agents that negotiate directly with consumer agents – all of which tie back to profitability.

We think a real share of e-commerce will run through AI. Not necessarily the entire checkout flow for every purchase, but the high-leverage layers like discovery, comparison, and product matching. By 2028, we predict roughly 40% of online purchases will touch an agent somewhere in the journey.

As interfaces shift from browsing to prompting, and eventually to voice, consumers will increasingly buy through AI because it saves time (reduced friction) and money (lower prices).

Wrap-Up

Evolutions in commerce aren’t new to us. We believe agentic commerce is the next shift, and we’re already spending time with founders creating the solutions that will power it.

To put the opportunity in perspective, U.S. e-commerce totaled roughly $1.3 trillion in 2024, according to U.S. Census Bureau data. If even 10% of that GMV begins or transacts through an agentic interface rather than a traditional search or storefront, that is about $130 billion of commerce rerouted through a new distribution channel. For investors, this is a shift in channel power that rivals the early days of search and social commerce.

If you’re building in this space – whether on the enablement, infrastructure, or transaction stack – we’d love to talk.

This article is for informational purposes only and does not constitute investment advice. Views expressed represent the opinions of Jump Capital. Jump Capital may have investments in or pursue investments in the technology sectors and companies discussed. References to specific companies do not constitute investment recommendations.

Front Page

Front Page