Accelerated Spending + 15 Months of Rate Hikes = Consumer Debt Challenge

Zero percent interest rates were fun while they lasted, weren’t they? Unfortunately, all good things end, and thanks to the ever-changing macroeconomic landscape, consumers, financial institutions, and the economy are in for a case of whiplash.

Just three short years ago, the stock market was soaring, the government was handing out payments to mitigate an economic disaster, student loan repayments were put on hiatus, and low-interest rates created an environment where folks felt like they were swimming in cash.

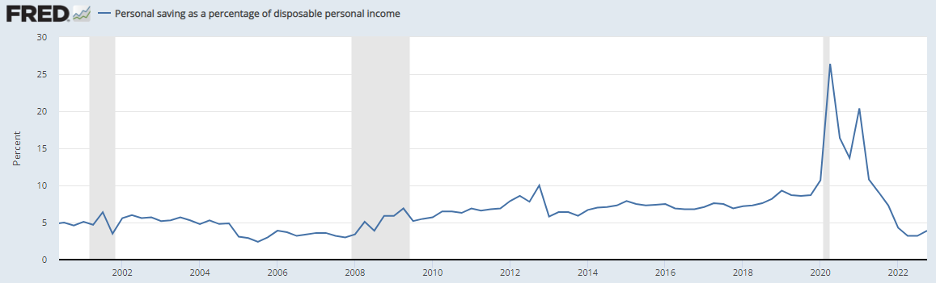

Fast forward to 2023, and the picture looks quite different. Layoffs, stagnation in home values, and slumps in the stock and crypto markets greatly diminished consumers’ cash reserves, disposable income, and perceived net worth. And if that wasn’t enough, people depleted their reserves by continuing to spend on all the experiences they had missed out on during the peak of the COVID-19 pandemic (aka revenge spending). This bullwhip effect can be seen in the time series tracking personal savings as a percentage of disposable income but certainly impacts different consumer segments more than others.

At the same time, innovation in financial services added incredible complexity to the credit scoring process. With over 60% of US consumers engaging with Buy-Now-Pay-Later (BNPL) services, credit bureaus have taken their own approach to tackle the issue of how best to incorporate this off-balance sheet data into the core credit files for a more complete picture.

And Credit Builder Loans (CBLs) have added credit history to traditional credit files that are not necessarily indicative of creditworthiness, thus blurring the clarity of creditworthiness. (Source) Wading through obfuscated credit indicators, both Fintech challengers and lender incumbents were incentivized to grow their loan book by venture capital and public market investors that valued growth over efficiency. It was a frenzy that was hard to resist.

Meanwhile, the Fed’s rapid reversal in interest rates to historical averages has the potential to shake up households’ ability to manage their debt burden. And that burden is heavy. In Q1 2023, it soared past a staggering $17 trillion. Early signs of delinquency rates for this debt indicate that consumers are starting to grapple with significant challenges. Delinquency rates for all debt increased to 3%, the highest since the third quarter of 2020 – indicating a worrisome trend that demands attention. (Source)

As consumers’ debt burdens grow, they also discover their dollar doesn’t stretch as far as it used to. Albeit still well below historical averages, delinquencies are on the rise, and consumer’s ability to repay a loan has become increasingly challenging with inflation’s impact on all spending and a job market marred by layoffs across companies of all sizes. Unfortunately, it seems almost inevitable that there will be increased defaults and delinquencies.

This brings us to a crucial question: How can key players introduce much-needed transparency and clarity to the customer’s loan journey?

To answer that, let’s dive into the key players that shape the consumer debt journey.

There are four major stakeholders that have a meaningful effect on the outcome of a particular customer’s loan, each wielding significant influence over the outcome. While their involvement may vary at different stages of the loan lifecycle, all stakeholders hold a vested interest throughout.

- The Consumer – At the center of the journey, customers bear the weight of a multitude of decisions. What institution do they enter into a relationship with? Do they have enough income to afford an additional line of credit? Which of their lines of credit do they prioritize repaying if money gets tight?

- Financial Institutions – Encompassing credit bureaus, loan originators, buyers, servicers, and the broader landscape of banks and credit unions – financial institutions’ interests and incentives are diverse. Fundamentally, this group has to make a complicated decision over and over again: can a given customer maintain their ability to repay a loan? To do this effectively, the financial ecosystem needs to share and analyze an ever-growing volume of data collected from an ever-growing number of sources and engage differently with their customers.

- Debt Collections – When the participants in a loan’s repayment path have exhausted options pre-charge-off, collections agencies work with customers and create payment plans to avoid further damage to their credit scores. Debt collections-based solutions focus on 2 business models: debt recovery arbitrage and debtor agents, both of which incur heavy risk via regulatory oversight and poor consumer experience.

- Government – The arbiters for equitable treatment and overall financial well-being of the nation, government plays a large role in rule-making and securing large asset classes (mortgages, student loans). However, firms servicing the government as their primary client are highly reliant on shifts in the political landscape, which significantly complicates evaluating investment opportunities. During times of financial volatility, governments tend to harden their regulatory stance, further reshaping the environment.

Understanding the interplay between these key players is vital in unraveling the complex world of consumer debt and navigating the path toward transparency and clarity in the customer’s loan journey, but we are really focused on solutions enabling consumers through financial partners and solutions with the FI ecosystem (#1 & 2).

Points of Investigation

We are continuously refreshing our understanding of the regulatory landscape and the dynamics of the value chain – we are focused on breaking apart and examining these two dimensions in the coming months.

Rohit Chopra, Director of the Consumer Financial Protection Bureau (CFPB), emphasized that rule-making around financial data ownership will be a high priority for the CFPB in 2023. (Source) Historically, each individual financial institution owned a segment of a customer’s financial data while the customer had to request access. As a result of an ongoing CFPB inquiry, that paradigm can be turned on its head, affecting who can hold financial data and the velocity and frequency in which data can be shared across partners. This potential shift has far-reaching implications.

Meanwhile, as for the value chain within core debt workflows – fintechs and the open banking revolution continue to shift and reshape the technology stack of financial institutions. Legacy institutions have a mix of on-premise and cloud-based services. In contrast, newer fintech entrants may be inherently cloud-native. However, firms still struggle to paint a holistic picture of each customer.

The key lies in tying together data from originations, monitoring, repayment, delinquency, and collections to enable financial institutions to engage with customers proactively and more effectively, leading to lower default rates and higher recovery rates. Customers can expect more accurately priced loan offers and new digital-enabled mediums for better communication during their repayment period, yielding a customer experience and lower charge-off rate.

As we navigate the regulatory landscape and unravel the intricate web of the value chain, we aim to stay ahead of these developments and deepen our understanding. By doing so, we can pave the way for the next generation of debt solutions and ensure that financial services meet the evolving needs of customers in an ever-changing landscape. In the coming months, we’ll detail this further, both with a podcast exploration and a more detailed post depicting the landscape and solutions.

If you and your team are building a product in this space, reach out to us: Sach Chitnis ([email protected]), Tarun Gupta ([email protected]), and Josh Shalen ([email protected]) to talk and debate this emerging problem.

Front Page

Front Page