Blog

The Digital Evolution of Back Office Finance

8/4/2020

Millennials have been the venture community’s darling for the past decade, attracting billions of dollars of funding for startups across industries. Within fintech, digital banks, robo-advisors, and personalization technology targeting millennials are front and center in the investment community. However, there is a generation that is an even more promising opportunity that is currently being overlooked – seniors. The growing senior population (i.e., adults ages 55+) control more wealth than do millennials, or any other generation. Furthermore, as they age, they are beginning to face unique challenges – from making money last through retirement to protecting against fraud – that provide unique opportunities to be overcome with innovation and better technology. Fintech for seniors is not just “Fintech with Big Buttons” (as we jokingly titled this post), fintech companies targeting seniors are solving significant, and unique problems for this demographic, and is an area we at Jump Capital are actively looking to invest behind.

Why Senior Fintech?

We all know that the population is getting older with the aging of baby boomers. Older adults will begin to outnumber children for the first time in US history. With life expectancy continuing to increase, our aging loved ones are experiencing longer and healthier lives than any other generation before it.

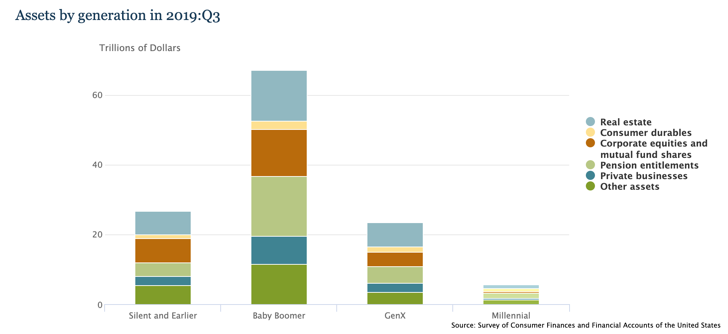

Beyond the growing population, seniors also control a majority – 65% – of the nation’s wealth. That amounts to more than $85T of household wealth (Figure 1). Seniors also control ~83% of investible assets. Do these figures pique your interest yet?

Figure 1

Seniors’ financial needs are as enormous as the wealth they control. Nearly half of boomers do not have savings for retirement, while those who do have modest amounts saved1. Furthermore, traditional sources of retirement wealth are undergoing funding challenges. Whether it be social security or changes to retirement benefit plans over time, seniors are in a precarious financial position to be able to afford their longer retirement phase. Even seniors who can afford retirement are looking for ways to protect it and plan to transfer wealth to the next generation. Wealth that has been built up in the silent and baby boomer generations is expected to become the greatest wealth transfer in history – estimated to be over $30T in financial and non-financial assets. Transferring wealth is complicated and brings about legal, financial, and emotional turmoil.

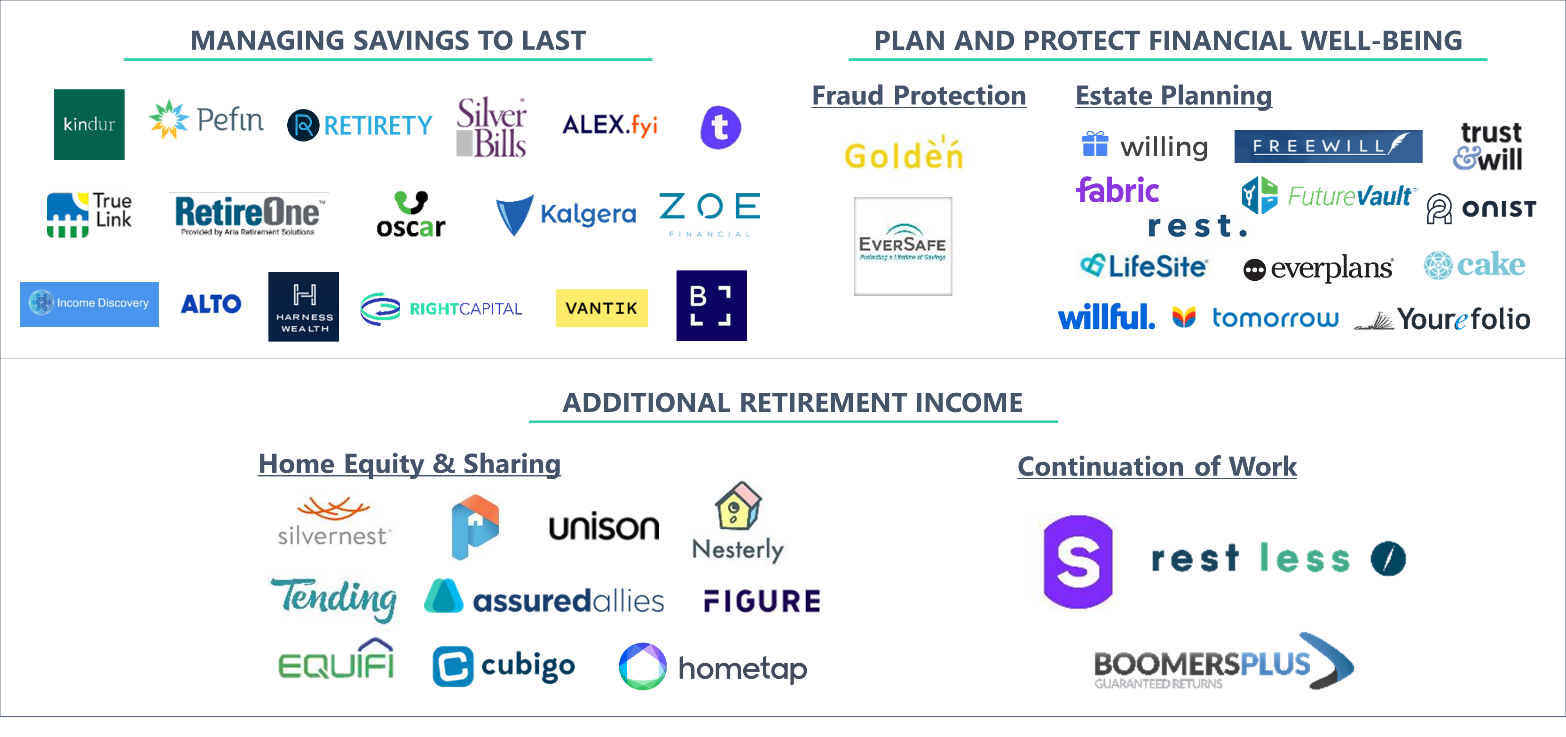

These needs create an opportunity for tools that a) help seniors manage their savings to last throughout retirement, b) increase income opportunities for seniors, and c) plan for and protect seniors’ financial well-being during retirement.

Senior Fintech Opportunities

a) Managing savings to last throughout retirement: The financial needs that are on a retiree’s mind are very different from the millennials that most financial management apps are serving. From decumulation of their savings, different investment strategies, need for unique financial products (e.g., annuities), exposure to fraud, and complexity of government benefits, seniors have a lot on their mind.

There are several companies out there looking to revolutionize financial advice needed by the senior population. From Kindur – the company built to help baby boomers ensure that their savings outlast their bucket list – to True Link Financial – the provider of financial services for vulnerable older adults – there are many startups looking to engage retirees.

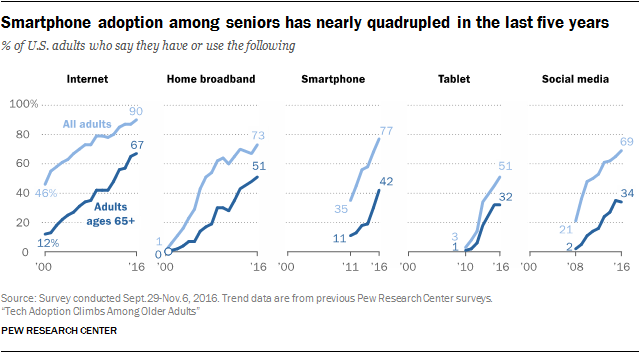

One challenge that Jump Capital saw across many of these firms is seniors’ preference for working with human financial advisors. Even though seniors are digitally savvy (Figure 2), there is still an overall preference and comfort with working with human financial advisors. An opportunity that accommodates this preference is for startups to target financial advisors and offer tools that help financial advisors meet the needs of their aging clients. We at Jump Capital are energized by tools that help financial advisors better serve the needs of seniors, as we see the financial advisor being a key agent in the financial relationships for seniors.

Figure 2

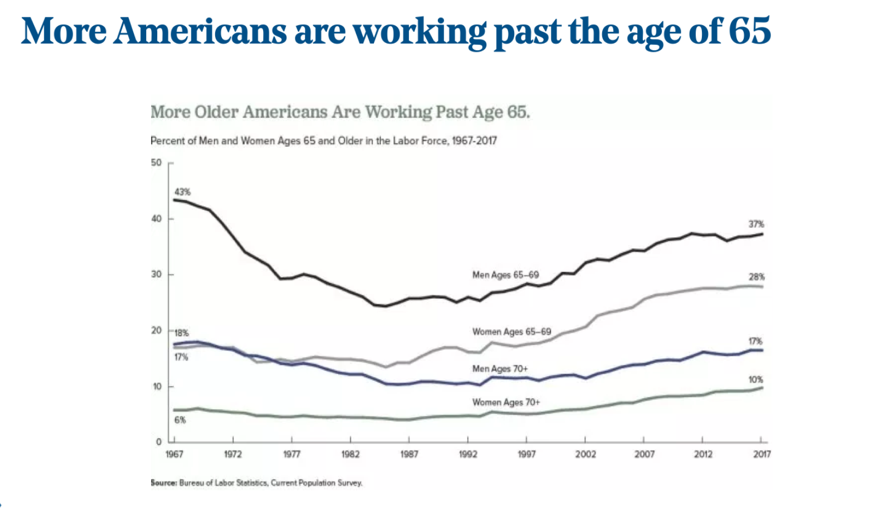

b) Opportunities for additional income in retirement: Another area that we explored was opening up new income streams for the aging population. With the rise of the gig economy, we have already seen older adults start to participate before or after they retire. Driving for rideshare companies has been one popular option for seniors to continue working. Unfortunately, COVID has limited the availability of some of this work, and seniors’ interest in taking work that could expose them to risks. Regardless of these recent challenges, as seniors live longer and costs of retirement increase, more adults over the age of 65 are continuing to work (Figure 3). Beyond gig economy work, companies like rest less are connecting seniors and providing information about job opportunities that are friendly to the older generations. Given the financial challenges of aging adults quoted above, Jump Capital will keep watching this space for companies that can reach seniors on a mass scale and offer flexible, senior-friendly jobs to introduce additional income in retirement.

Figure 3

Another opportunity for new income streams is tapping into seniors’ wealth that is built up in their homes. With the trend of aging-in-place, seniors prefer to stay in their homes if they can afford to. There are many companies out there making the process of getting home equity loans simpler (e.g., Figure). We see older adults as a key target customer segment for these companies. Furthermore, there are home-sharing companies that allow seniors to stay in their homes with a roommate, while gaining additional rental income. These companies also try to appeal to the challenges seniors face while aging in their homes. Difficulties such as mobility or home upkeep can be solved by having an inter-generational roommate helping out around the home. Homes are generally the largest asset that seniors own, so we continue to see companies that are looking to unlock this wealth as a large opportunity to unlock cash for seniors in retirement.

c) Plan for and protect your financial well-being: End of life planning and care is a complex and delicate conversation for seniors and their families. Seniors need many legal documents to plan for this phase of their life – wills, trusts, powers of attorneys, advance directives. Companies that aim to ease these conversations, reduce the complexity and price, and put all of the information in one place would allow seniors the ease of mind that they have appropriately planned for the end of life stage.

In addition to planning, seniors also need to protect against fraud as one of the most-targeted generations for scams and fraud schemes. In addition to decreased mental capacity, seniors also have built up wealth that make them the ideal candidates for these schemes. Companies that can automate fraud protection as well as incorporate family members or caretakers into the situation can help seniors protect their financial well-being to last during retirement. However, we see similar challenges for these companies as I did for financial planning tools targeted towards seniors in terms of customer acquisition. While an important service, seniors prefer human financial advisors to discuss financial well-being. Financial advisors that can offer this protection may find that it helps win customer relationships, as well as appeal to caretakers and family members that would inherit seniors’ wealth.

Similar to fraud protection, incorporating family members and caretakers into seniors’ financial planning can help ease the transfer of assets between generations when that time comes. An additional complication is the fact that most financial advisors are nearing retirement age themselves. In addition to the clients’ changing generations, wealth management firms will face a generational shift in their advisor population. Software that can help firms manage through these relationship changes between advisors and their clients could help firms maintain their assets under management in the expected wealth transfer.

Summary

In summary, at Jump Capital, some of the areas of senior fintech we are most excited about include:

Aging is expensive and emotional. If companies can simplify the financial complexities that come with aging, then seniors, their families, and the wealth management firms representing them can all benefit. We look forward to continuing to monitor this area for innovation that helps seniors navigate the financial requirements in retirement.

Market Map

Thank you to Dana Granadier for her contributions to this post

Sources

1 Boomer Expectations for Retirement 2019

Survey of Consumer Finances (SCF) 2016 by Federal Reserve

Current Population Survey from Bureau of Labor Statistics