Driving change in finance: empowering CFOs with automation

CFOs are at a crossroads, and automation is the key to success. Long underserved by tech solutions, many finance teams continue to be bogged down by archaic processes and legacy systems. But the tides are changing.

While the role of the CFO has been evolving within organizations for a number of years, downward pressures from the current macro environment have rapidly accelerated the need for innovation to support the increased demands of the job.

Job creep, in particular, has become a significant stressor, adding more responsibilities to the already heavy workload for CFOs. According to CFO Dive, 81% of finance leaders believe their day-to-day work is the most intensive compared to any other C-Suite role. This is mainly because finance chiefs are increasingly being given new cross-functional demands, elevating their oversight within organizations. For instance, as key risk officers, CFOs are progressively being tasked with increasing responsibility for cybersecurity and tech compliance strategies, which have also become more complex. In fact, cybersecurity has ranked as one of the top three challenges faced by finance leaders for the second consecutive quarter, as per a survey released by Grant Thornton in February.

Additionally, talent-related challenges are abundant, as professionals with core finance competencies have become harder than ever to hire and retain.

Externally, financial leaders are currently facing one of the most challenging macroeconomic environments.

The cost of capital is at a historical high and will continue to increase as the Fed pursues additional rate hikes (source). On top of this, equity raises have slowed to a crawl, and debt availability continues to be threatened by the ongoing banking turmoil. All this culminates in a world where financing your organization is no longer as easily accessible as in prior years – and even when it is – it comes at an uncharacteristically high cost.

Put another way, all businesses are being pushed by stakeholders towards prioritizing capital efficiency and profitability as the top objectives. In light of this, CFOs must not only effectuate tighter budget controls and cost management strategies but must also be able to frequently and proactively generate high-fidelity financial insights to provide visibility to said scrutinizing stakeholders.

Today’s Tech Stack is Built For Yesterday’s CFO

The biggest hindrance for CFOs trying to address the current climate is their tech stack. The finance Software-as-a-Service (SaaS) space has seen a surge of point solutions, leading to a highly-fragmented and non-uniform set of systems and processes across organizations.

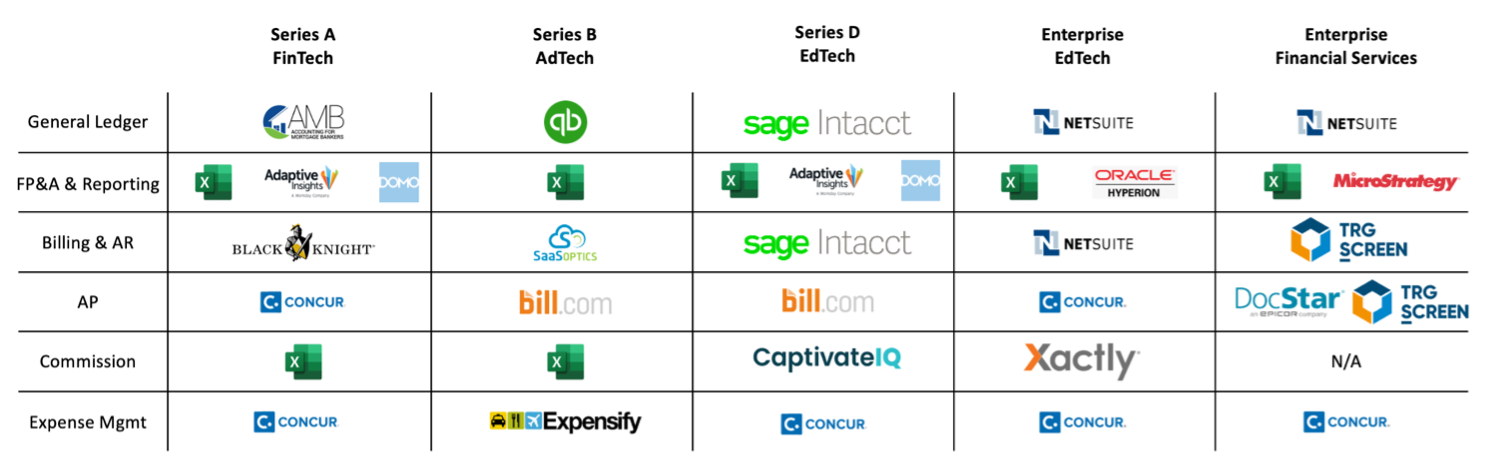

We polled a few companies of different sizes and verticals about their finance tech stacks and got a range of tools, as depicted below:

Most sub-functions under the typical finance scope have independent solutions, purpose-built for that specific set of tasks and the specific associated data. This means that in most cases, these systems don’t easily talk to each other without intensive custom-builds or, most often, manual intervention. Often this manual effort is documented in Excel, creating yet another data silo.

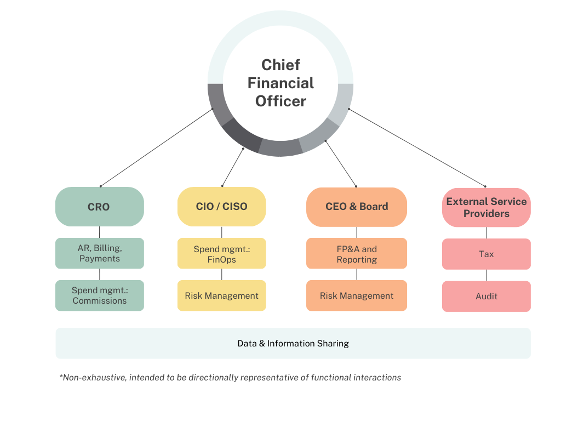

This creation of blind spots gets exacerbated when you layer on the data inputs that live outside the finance function but are prudent to financial operations. In one example, we spoke with several CFOs across industries and sizes about their budgeting process.

In almost every case, finance leaders depicted either a series of live conversations or a few email threads with other functional heads to understand individual budgets for the quarter and how each function was tracking toward budget. Then, the finance person takes this unstructured, sometimes vague data (“We’ll be slightly above our cost estimates this month”) and translates that to usable inputs for their Financial Planning and Analysis (FP&A) reporting. Doing this usually requires extensive back and forth, resulting in massive inefficiencies and data lags (aka, non-real-time data) in the overall FP&A process. This often makes the whole effort far less effective and proactive as is required for budget management today.

Breakage points like this are not exclusive to FP&A and can be identified across nearly every finance process, especially as they become increasingly reliant on data and tools from other teams. According to Financial Director and Workday research, 73% of finance professionals view the requirement for timely and comprehensive data as the number one challenge facing their organization today. Specifically, almost a third of respondents named collaboration with non-finance teams as an issue – the result of outdated or siloed technological systems. These siloes are not only a management nightmare, but more critically, they increase the risk of financial oversights, misstatements, or poor cash management decisions. Current tech stacks are not built for the finance leaders or teams of today.

The Opportunity

Given the current macroeconomic headwinds, it would be ironic if we suggested that CFOs should overhaul all

existing solutions and invest in entirely new systems. Instead, we focused on identifying the specific interactions where we believe inefficiencies are the highest, the most resources (time and money) are being used, and where businesses have the most to gain from improved tooling. The unanimous common outcome is the need for solutions that better connect and contextualize information for specific use cases.

Here are the use cases we found most compelling:

Data Automation – As highlighted earlier, data and information sharing is one of the biggest challenges to more seamless processes both cross-functionally and within the finance function itself. We believe a meaningful needle-mover for finance leaders are solutions that translate, format and connect data appropriately across disparate systems. Tools like this have long since emerged across other functions, such as marketing and cybersecurity, but finance use cases have been underserved. We envision solutions here arising either as independent platforms or APIs, or may be built-in as enabling technologies to other point solutions across the finance stack.

Risk Management – Cyber risk is becoming an increasingly prominent agenda item across board rooms, where CFOs are now responsible for educating and informing stakeholders of their risk exposure and recommendations. Historically, cyber postures have been discussed in the context of “threats” and “vulnerabilities” – terms incredibly relevant to CISO teams, but which don’t translate clearly to business context. Today, CFOs need to be able to convert these messages to financial terms by quantifying and measuring the risk as well as by determining the investments necessary to mitigate. Solutions that enable CISO and CFO teams to represent cyber risk in these digestible terms are attractive.

Spend Management – SaaS costs have ballooned in the past few years, becoming a line item that can meaningfully threaten company profitability. According to a recent report, SaaS pricing inflation is increasing at four times the rate of global inflation.

Though many SaaS management vendors have come to market, we believe two areas, in particular, are ripe for innovation:

- FinOps, specifically bridging cloud spend to the finance suite. Many legacy Cloud Optimization players are built for engineering teams, helping with technical requirements like resource provisioning. These don’t solve for the lack of cost predictability that impacts overall budget. Translating cloud use to the finance suite is a key area of opportunity, especially as we see increased adoption of complex cloud services leveraging AI.

- Commission Management. Current commission management often lives siloed within the revenue function and doesn’t easily or accurately tie to finance’s forecasts. Increased complexity in compensation plans has added challenge and often results in long lag times to calculate and, consequently, course-correct. Especially in the current macro where shifted priorities are forcing organizations to reconsider sales incentives more frequently, solutions that can handle complicated plan iterations and real-time data sharing capabilities are attractive.

AR, Billing, & Payments – In prior years, AR management is a category that has consistently been underinvested in. However, payment and billing mechanisms have become increasingly complex, with demand for flexible models, such as usage-based, value-based, hybrid, installments, services, etc. on the rise.

Consequently, many legacy solutions have difficulty accommodating these new structures, resulting in slow processes and lengthy DSO times. Because AR automation can accelerate cash flow while reducing collection costs and potential default risk, we expect solutions here to gain traction. There are also certain verticals with highly specialized and complex AR processes where we see purpose-built, full-stack solutions emerging – this includes Professional Services, Logistics, Construction, and AI.

FP&A and Reporting – There are many newcomers attempting to be “Excel 2.0”, which we believe will be a challenging feat given the widespread behavior change it requires. Where we are more excited about the opportunity, however, is in dynamic tracking and reporting capabilities between functions. Analyses done in Excel today largely stay within the finance realm, and how other functions track those analyses is unknown on a regular cadence. Solutions that enable cross-functional visibility and collaboration are exciting.

Service Automation – Across finance organizations of all sizes, external services consistently account for 10-15% of all functional spend (Source). Typically, this spend is allocated towards consultants, auditors, accountants, and tax professionals. While we don’t anticipate the use of external services by finance leaders to meaningfully shrink in the near future, there is an opportunity to bring some spend in-house with better automation and/or to enable improved collaboration between internal and external parties. Specifically, we believe tax management and audit preparation are two big opportunities here.

Across all of these, we, to no one’s surprise, expect AI and the rapid democratization of LLMs to play a meaningful role, as we highlighted in our February post on purpose-built AI. While AI is not nearly in a place to displace finance teams, evident by ChatGPT’s recent failure of accounting class, it will be a driver to enabling more innovative software in this space.

Building something for the finance suite? Reach out to [email protected].

Front Page

Front Page