How Issuers Can Win in the Lose-Lose of Chargebacks

It’s easy to overlook chargebacks. If a good or service isn’t received, a merchant makes a mistake, or fraud is suspected, a customer may choose to initiate a chargeback.

With global chargeback volumes expected to hit 337 million transactions by 2026—a 42% increase from 2023, according to MasterCard— it’s clear this is a growing problem that demands attention.

To address this, companies like Chargeback Gurus, Riskified, Forter, and others have emerged to help merchants, who historically bear the brunt of the operational burden and financial liability for disputed transactions. The average chargeback costs $191, with merchants absorbing $128 of that. But the costs don’t stop there—acquirers and issuers pick up the rest, averaging $26 and $37 per chargeback, respectively, as reported by Fit Small Business.

As e-commerce continues to rise, along with consumer debt and a troubling increase in “friendly fraud” (42% of Gen Z admits to engaging in friendly fraud compared to just 5% of Baby Boomers), these numbers are likely to keep climbing.

With that in mind, it’s time to take a fresh look at the chargebacks and disputes landscape from a perspective that often goes unnoticed: the issuers.

Issuers are feeling the heat

Liability is increasingly shifting to issuers, and the financial toll is significant. In 2023, Americans disputed a jaw-dropping $65 billion in credit card charges, according to Sift Research. The average cost of disputes also increased by 16% last year, further straining issuers.

As market dynamics evolve and regulatory scrutiny intensifies, issuers are more often on the hook for these escalating costs. While merchants have adopted preventative measures like fraud detection tools and chargeback management software to mitigate some of their liability—issuers are playing catch-up.

A poor dispute experience can lead to decreased card usage, and the operational costs required to dig deeper into many disputes often outweigh the benefits. As a result, issuers are often eating the cost of disputes beneath a certain threshold. The cost of mistakes is high— Citizens Bank was fined $9 million last year for failing to “properly manage and respond to customers’ credit card disputes.”

Adding to this pressure are new initiatives such as Visa Compelling Evidence 3.0, which give merchants a straightforward path to improve their dispute win rates.

The complex world of chargebacks

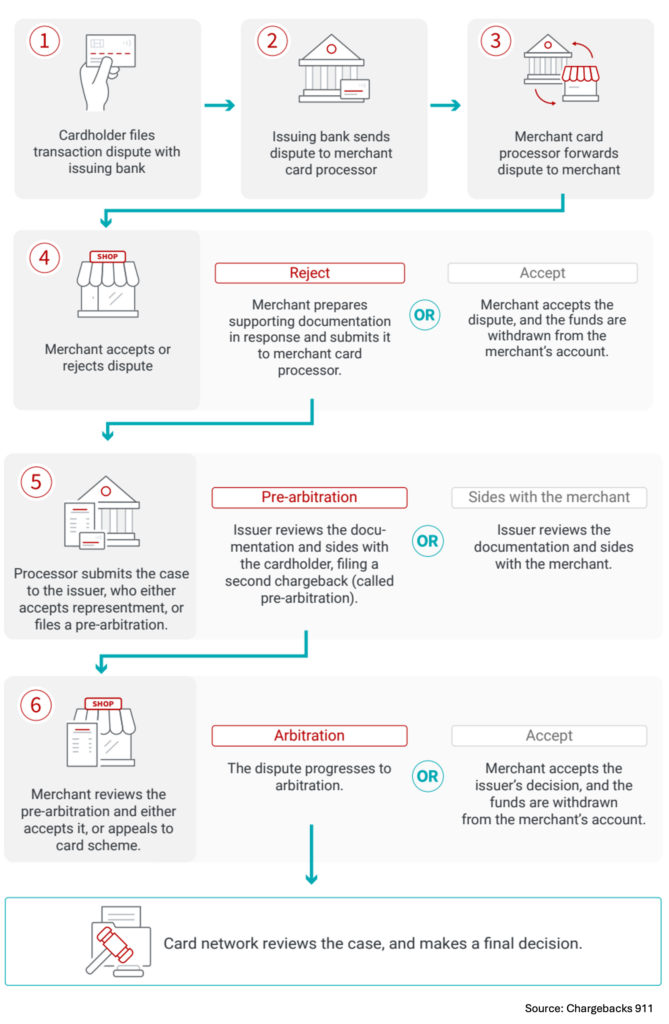

On its surface, disputing a charge seems straightforward—just a few taps in a banking app, and it’s done. In a matter of minutes, without ever having to speak with anyone on the phone, customers can easily log a dispute. But what appears simple on the surface is, in reality, a highly complex, time-sensitive process that involves multiple parties. Moreover, the underlying rules for handling disputes haven’t changed much since the chargeback process was first introduced in 1974, leaving issuers to navigate a convoluted and labor-intensive system.

The Chargeback Process

Issuers are governed by Reg E for debit cards and Reg Z for credit cards, which impose strict timelines and coordination requirements. Representatives must coordinate with the merchant, the acquiring bank, the card networks, and the customer. The process is highly manual, with plenty of room for error, and the costs of getting it wrong are high—Mastercard’s recent fee hike for arbitration cases (raising its case ruling fees from $440 to $575) is a prime example.

Still, as these challenges mount, issuers rely on outdated, costly, and inefficient processes to manage chargebacks at scale.

Better solutions are budding.

The current state of dispute management is ripe for disruption. Legacy solutions are either expensive, fully managed services or repurposed workflow tools requiring heavy human intervention. While some of the larger issuers have built in-house solutions to manage their disputes intake, across the board, the existing processes remain exceedingly manual and high touch.

The rules-based nature of dispute management combined with the ability to analyze and make decisions based unstructured data makes this space ripe for disruption.

Emerging solutions have the potential to significantly shorten information intake, consolidate and clean disparate data sources, automate status communications, and connect directly to network association requirements.

By integrating data enrichment capabilities offered by the networks, decision-making can be further optimized, reducing the number of cases that require human intervention and leading to a more uniform customer experience.

We see a huge opportunity in the long tail of debit and credit issuers.

Consider a small financial institution handling $200M in payment volume with a 0.5% chargeback rate—this equates to $1M in chargebacks or around 11,000 cases at an average order size of $90. At $37 per chargeback, this costs the issuer around $400,000, most of which is operational spend.

From our conversations with issuers, a solution that could meaningfully reduce these operational dispute costs would be compelling, directly impacting the bottom line.

Moreover, effective solutions for debit and credit could be adapted to combat fraud more holistically across other payment channels within the same institution. For instance, peer-to-peer payments like Zelle represent approximately $400 billion per year in the US, with total P2P fraud losses reaching an estimated $1.7 billion in 2022, according to Forbes. ACH payments, which amount to over $80 trillion in US volume, see an estimated 0.03% network return, equating to $24 billion in fraud annually.

BNPL transactions are already about 3x more likely to be disputed and represent $80 billion+ in the US. The Consumer Financial Protection Bureau (CFPB) recently announced that BNPL providers will now be considered card issuers, making them subject to specific Reg Z provisions. As real-time payments continue to gain traction, there’s an increasing need for new fraud prevention and dispute resolution infrastructure. The UK, for example, is currently working to strike the right balance between the benefits of real-time payments and the need to protect consumers from fraud.

With the shifting regulatory burden, evolving consumer expectations, the saturation of merchant dispute solutions, and the rise of friendly fraud, issuers face mounting challenges. However, the clear ROI for issuers makes this a prime area for rapid adoption of new solutions.

We’re particularly interested in startups like Casap, Efficio, and Decisionly, which are focusing on chargebacks from the issuer’s perspective. As payment volumes and options continue to grow, and as new tools streamline workflows, we believe the approach to dispute management in financial institution back offices is on the brink of significant transformation.

If you’re building in this space, connect with us. We’d really like to chat.

Front Page

Front Page