The Great Reordering: AI Forces Professional Services to Defend Their IP and Redesign Their Org Charts

As a wave of LLM wrappers sell to legacy firms, founders can capture labor arbitrage through proprietary IP and organizational redesign

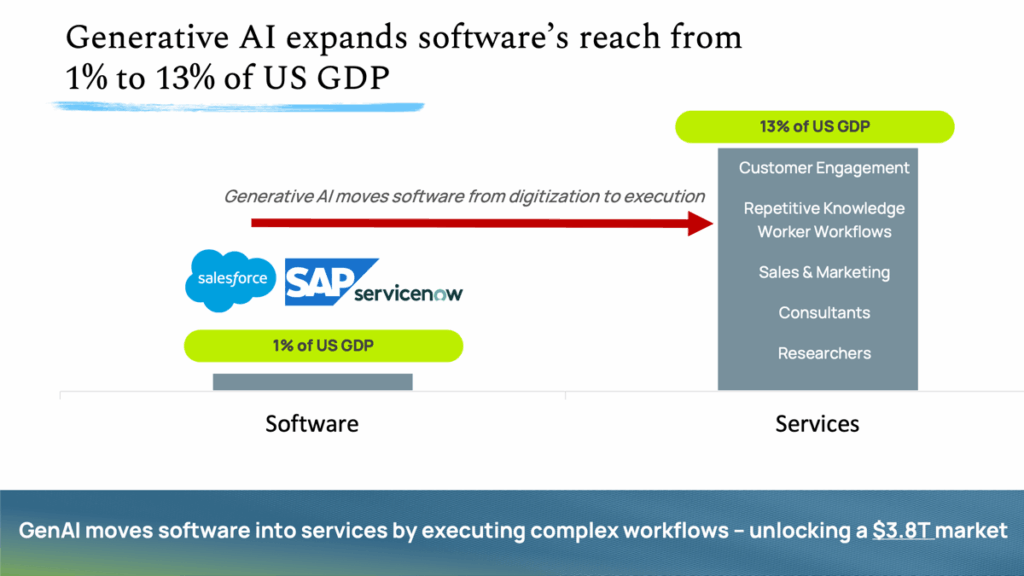

Software ate the world by making businesses more efficient, allowing them to do more with the same headcount. GenAI is different. It doesn’t speed up work as much as it reshapes who does the work, collapsing workflows that once required entire teams.

That shift is a profound opportunity,

Today’s software market commands 1% of US GDP. GenAI extends software into services where execution is the product, raising the addressable market to 13% of US GDP.

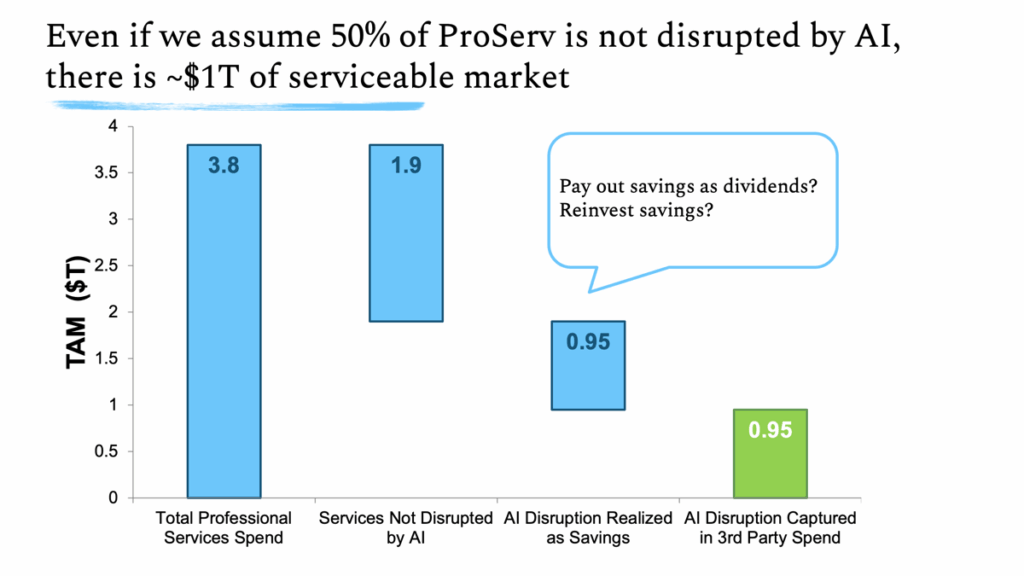

Even if half of the professional services market forgoes AI adoption, there’s still a roughly $1T in addressable market that we expect will only expand over time.

That’s because AI-enabled ProServ firms will harvest new profits that they can either pay out as dividends or reinvest into growth. They could expand product offerings, attack new geographies, or build out new service lines. The list goes on.

We’ve seen founders take three approaches to capture this opportunity:

- Sell Software. AI software businesses can sell products to existing ProServ firms.

- Sell the Work, Grow Organically. AI-powered services firms can incorporate and grow organically by poaching clients from incumbents or servicing clients where it is uneconomic for incumbents to compete.

- Sell the Work, Grow Inorganically. Founders can acquire existing firms, retool them with proprietary AI, and redesign the org structure, then drive revenue and margin expansion through organic and inorganic growth.

At Jump, we believe there’s space for each approach. The crucial question is whether AI is merely a wrapper around the services business or whether AI penetrates the core service output and organizational design. As adoption accelerates, we believe breakthroughs will come from proprietary AI stacks that drive feedback loops and enable dramatic productivity improvements. Firms that optimize for these two mandates will deliver rapid time-to-value and drive organic growth as opposed to extracting incremental efficiency from legacy models.

Where we see opportunity

When evaluating any market, we ask: is TAM large enough to justify venture scale returns? Are there technological, regulatory, or cultural tailwinds driving broad-scale behavioral change toward disruption? Will those forces create wedge opportunities where founders can deliver fast time-to-value?

Professional services check all three boxes. They drive 13% of US GDP. Their workflows are strong fits for automation. And partners at ProServ firms across our network stress they’re already feeling pressure. It’s harder than ever to defend fixed fee structures as junior employees offload work to LLMs.

The real question becomes, which types of organizations are most vulnerable?

Our view: AI-enabled ProServ is a labor arbitrage opportunity. Founders who build proprietary AI flywheels and rethink decades-old team structures can deliver services in ways that make it difficult, or even impossible, for incumbents to match.

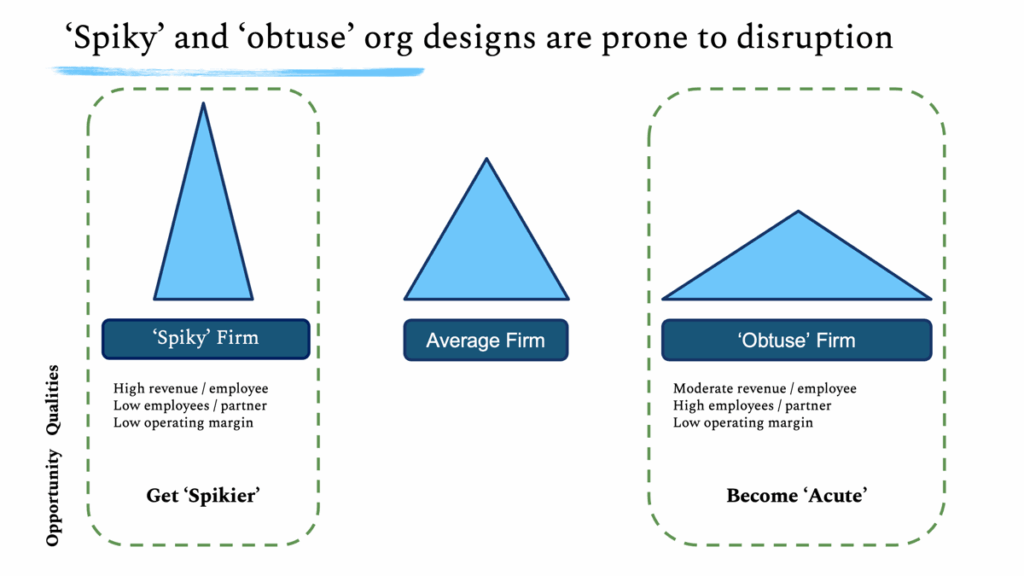

Using this framework, we think that “spiky” and “obtuse” organizations are most susceptible to this labor arbitrage opportunity.

Spiky organizations: lean teams, sky-high revenue per employee, but proportionally high compensation and thin operating margins. Examples: M&A advisory, corporate law, management consulting, private markets investing, and more. Obtuse organizations: bureaucratic teams with armies of employees per partner, often doing repetitive work. Examples: Tax / FP&A, expert networks, and market research come to mind.

Tactically, the opportunity lies in utilizing proprietary AI and lean team structures to enhance both revenue per employee and operating margin. In other words, successful founders will make “spiky” organizations spikier or make “obtuse” organizations “acute.”

In either case, margin improvement is the foundation. To command venture scale exit multiples, founders should aim for software-like gross margins; 70%+ is a good starting target. 80% or more is even better.

Adoption challenges and opportunities

Each ProServ category is progressing along the adoption curve at its own pace.

Some, such as tax, FP&A, and legal, have already seen the adoption of software. Others, like insurance brokerage, investment banking, management consulting, market research, executive recruiting / headhunting, lobbying / fundraising, public relations, remain early in the disruption cycle.

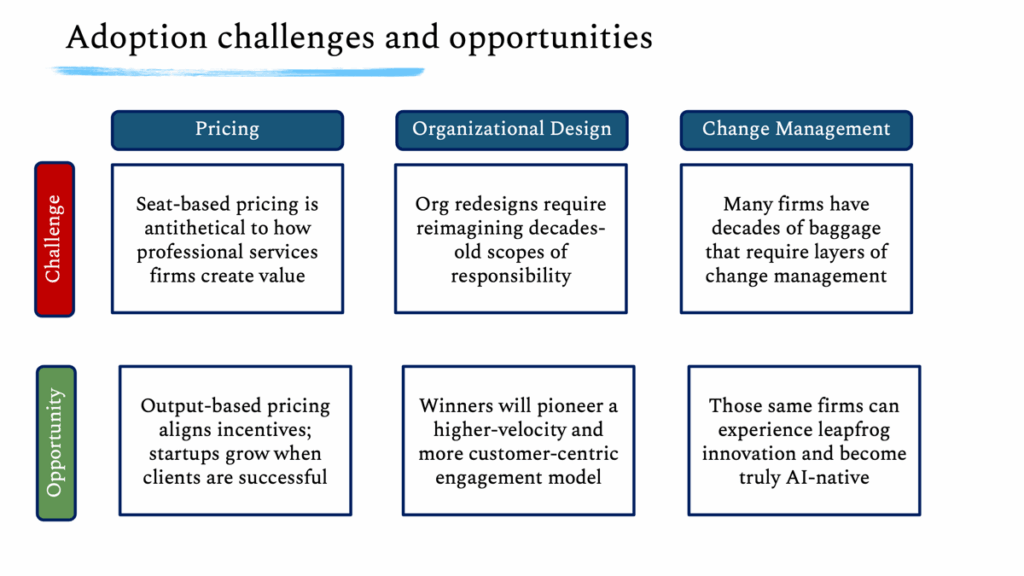

Across the board, we’ve seen three persistent adoption challenges emerge. Founders who crack these will create competitive advantage.

The first challenge involves pricing.

Seat-based pricing is antithetical to how services firms create value. Software grows by adding seats. Services grow by producing outcomes.

Pricing structure needs to evolve. We’ve seen fintech and foundation model companies innovate here. Stripe often pairs commitment-based pricing (e.g., its Tax and Billing platforms) with transaction-based pricing (payment processing). OpenAI and Claude often pair minimum user commitments with usage credits for advanced functionality (DeepResearch, Agent, etc.).

Anecdotally, AI-native startups are experimenting with similar approaches, typically via credit-based models. We think AI ProServ startups can learn from this. Charging base commitments ensures client buy-in, and outcomes-based pricing aligns incentives by driving growth only when both vendor and client are successful.

The second challenge involves organizational design.

This requires a ‘back-to-basics’ exercise: rethinking, inside-out, how firms interact with clients and allocate responsibility.

Take tax as an example. Before AI, a partner manages a few senior managers, who in turn manage a bench of associates spending most of their time on prep and data entry. After AI, the partner oversees one or two managers, who work with a handful of associates almost entirely on strategy. AI absorbs the prep and filing, freeing humans for higher-value client engagement.

The redesigned team unit can deliver a higher–velocity, more customer-centric engagement model. Done well, the AI-enabled team can make it nearly impossible for incumbents to compete, either on speed-to-value and/or by unlocking market subsectors incumbents have historically ignored.

The last challenge involves change management.

Many professional services categories, legal among them, lagged in past innovation cycles (e.g., Cloud) because of bureaucratic organizational structures, privacy and security concerns, and scars associated with botched software implementations. With AI, there’s also fear of displacement. Employees need to see that AI and job security can coexist.

The burden of trust is high, but the prize is worth it. Firms that successfully navigate change management will not so much adapt as they will experience leapfrog innovation. Legacy organizations could, for example, bypass the Cloud adoption cycle and go straight to AI-native. This is profound because, while software can streamline our existing workflows, it can’t abstract away the parts of work that are dull, tedious, or draining. AI can. We may even see a spike in job satisfaction as human employees spend more of their time driving value.

The bottom line

GenAI is reshaping the $3.8T US professional services market.

Founders are taking three approaches: (1) selling software, (2) designing AI-native firms and selling services organically, and (3) acquiring and existing services firms, then reimagining them with AI. Across approaches, the real winners will utilize proprietary AI to capture labor arbitrage through redesigned organizational structures, rethought pricing and delivery strategies, and successful change management.

This is the first in a series of posts on AI’s disruption of professional services. We want to connect with founders building across the professional services ecosystem, especially those re-imagining M&A advisory, consulting / strategy, product / market research, expert networks, and insurance brokerage. If you’re rethinking ProServ with GenAI, reach out to [email protected] and [email protected].

This article is for informational purposes only and does not constitute investment advice. Views expressed represent the opinions of the author and Jump Capital. Jump Capital may have investments in or pursue investments in the legal technology sectors discussed. References to specific approaches or technologies do not constitute investment recommendations.

Front Page

Front Page