FP&A’s Moment of Truth: Why CFOs are Rethinking Techstacks

A few months back, we discussed the increasing demands on CFOs and their finance teams. They’re being stretched thin, trying to do more with less while dealing with fragmented, siloed legacy systems that require manual workarounds.

In that post, we highlighted FP&A and Reporting as high-pain processes with meaningful risks if handled inaccurately. Since then, we’ve spoken to a number of leaders about their specific FP&A challenges. Here’s what we heard:

- Data collection is manual and inefficient. FP&A teams rely on information from every function to inform their analyses, but getting that information today is almost entirely manual. This is not only highly inefficient and time-consuming but also prone to error – especially during trying macro times (say, in an incessant rising interest rate world). We consistently heard from FP&A managers that anywhere from 40-70% of their team’s time was spent collecting and cleaning data.

- Budgets become “set it and forget it,” limiting agility. FP&A leaders typically set projections periodically (e.g., quarterly) based on manual data inputs. But they lack ongoing visibility into that data, such as pipeline or marketing spend, to track actuals against budget. This is partially because of piping (old solutions don’t make it easy to ingest data continuously), and partially because of the time it takes to process the data even if collected. All of this culminates in slow reaction times, preventing finance leaders from making informed, in-time decisions around resource allocation or investment.

- Collaboration is lacking.

Ironically, FP&A lacks collaborative tools. There are few FP&A solutions today that are easy to use across multiple constituents. Current solutions force siloed work due to their complexity to use and offline nature. This can lead to poor data governance, reconciliation errors, and information loss. - Current tools can’t handle complexity. While there may only be one defined projection for an organization, there are often multiple routes that can be taken to get there. Finance leaders consistently stated they need a better way to model these potential routes based on different inputs, sometimes including those outside of typical financial ones. Poor UI and technical complexity make doing that with existing SaaS tools a challenge.

Generational Changes

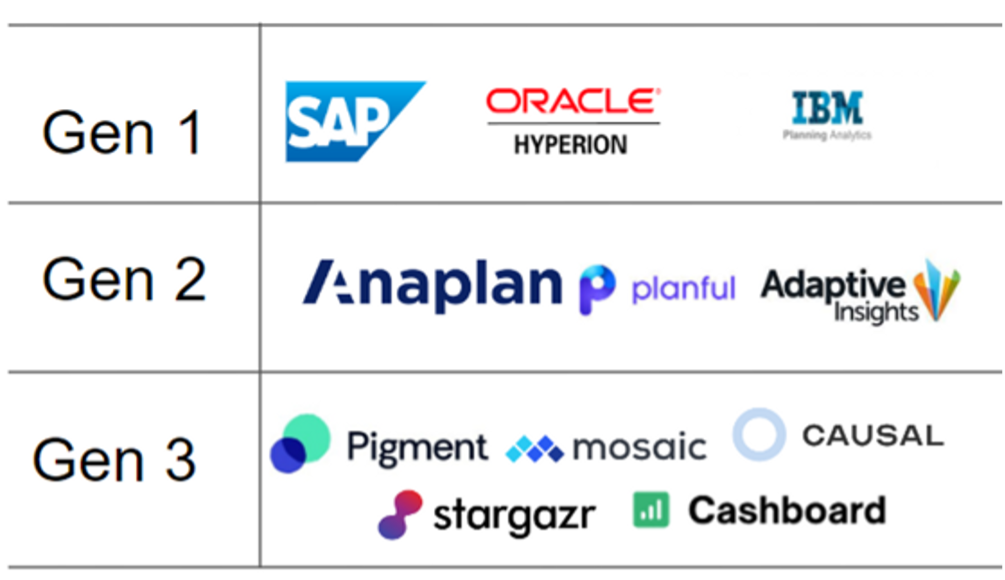

Solutions have evolved through three generations:

Gen 1: Tools built for deep pockets: large enterprises with the cash to spend on the technical and consulting expertise required to get these on-prem solutions up and running. These implementations often take months and, even when in place, may not be ideal. Once deployed, these solutions still require technical teams and internal training to maintain, update, and run analyses (as many have their own native formula languages).

People often think that because these solutions target enterprises, they require these services and customization, and that will never change. But, my view is the opposite: it’s because these solutions require expert customization to even function properly that they can only

make sense for enterprise buyers. They lack the modern architecture, intuitive UI, and flexibility to be used inexpensively and therefore are only purchased by the largest customers.

Gen 2: Offer enterprise features to midmarket, via cloud delivery. These cloud-native solutions greatly reduced the time and cost to implement by modernizing their architecture and adding a few new capabilities. However, they still miss the mark on flexibility and usability.

We heard time and again from finance leaders using Gen 2 FP&A tools that building in customization, dynamic reporting, and unique data processing capabilities continues to be a challenge and sometimes still requires technical know-how. It’s because of this rigidity that we see so many midmarket companies primarily using Excel as their source of truth and uninterested in adopting new solutions.

Gen 3: The newest set of challengers taking scalability lessons from Gen 2 and adding collaboration and usability – attempting to solve the mistakes of their predecessors. The advantages are obvious, and why we’re starting to see a few make a splash in the market. However, we think it’s still early days in the innovation cycle, and there are a few characteristics we’d love to see new solutions focus on.

The Potential for Gen 3

Gen3 <> GenAI: We’re wary of suggesting that you can slap AI on anything and solve problems, but we do believe that AI can help the FP&A suite specifically, starting with automating mundane tasks.

As outlined earlier, a huge chunk of FP&A employees’ time today is spent on data processing. In fact, estimates put the financial toll of “low-value data management work being done by high-value analysts” at $6.1 billion across organizations.

GenAI capabilities can be incredibly powerful in handling these activities by improving data ingestion, labeling, and normalization. Ultimately, these capabilities can make it significantly easier for FP&A teams to effectively leverage disparate and complex datasets.

Second, is the potential of AI to make analyses more robust. This can mean modeling more scenarios faster, building predictive forecasts that deliver increased accuracy, or speeding up reconciliation processes with anomaly detection – all of which promote proactive vs. reactive decisioning.

Last, and perhaps the lowest hanging fruit, is to enable collaboration. The best example of this is what Datarails just released: FP&A Genius, a chatGPT style FP&A tool to enable employees to simply ask Genius a question and immediately have an answer, vs. relying on finance employees to pull together charts and reports.

Overall, with the right governance and controls in place, AI can be a meaningful value-add to FP&A solutions and can result in a broadening of the purview of this function. Traditional FP&A teams will have significantly more time to focus on higher-value initiatives, potentially redefining their core responsibilities altogether.

Integrations are key: With better architecture, more integrations enable more usable data. Broad and deep integrations have historically been hard to solve by legacy systems partly due to the data paradox this introduces.

While theoretically, more integrations mean more data which means more effective analyses, legacy architecture has not been able to support the processing capabilities needed to make that data easily usable (without a data scientist, that is). Basically, even if they existed, more integrations would do more harm than good.

FP&A users got used to this world and resorted to the manual data processes we’ve droned on about in order to use Gen 1 solutions. However, with more intuitive data usability in Gen 3, integrations can and should now be the focus point. Seamlessly being able to get the necessary data across systems (ERP, HRIS, CRM, etc.) will be the key to delivering quick time-to-value and ROI without significantly disrupting existing workflows.

Solve for complexity: Support nuanced needs upfront to easily scale across markets – don’t just focus on team size. We hinted at this prior, but to date, whenever new solutions come to market, they do so mainly with the goal of bringing big-team capabilities to small teams.

While there’s certainly a need for this, we think it’s more important to build for financial complexity vs. the size of the business. Factors like lengthy supply chains, high transaction volumes, high working capital needs, low gross margins, and complex regulatory requirements all make FP&A requirements more demanding. Our belief is that building for these nuances early will help ensure a solution can easily scale across markets.

While it’s still early days, there’s no doubt that we’re at a tipping point: macro pressures, internal changes, and rapid tech innovation is driving FP&A leaders to realize what new solutions can bring and forcing them to re-evaluate their current stacks.

That said, finance leaders tend to be skeptical of new technologies, often looking for clear ROI and longevity in their investments. Said another way, they aren’t afraid to wait for the next best solution but rest assured, we believe they are eagerly watching out for it – and so are we.

If you and your team are building a product in this space, reach out to me at [email protected].

Front Page

Front Page